Table of Content

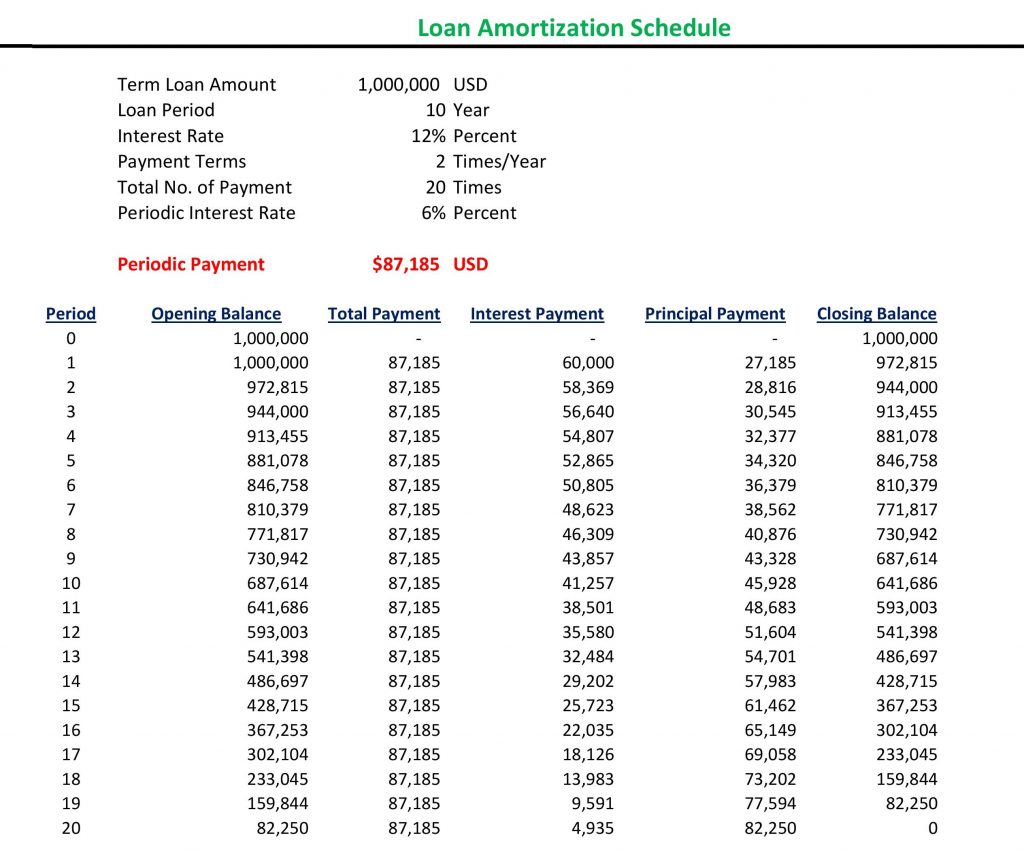

It is also a way to consistently make extra payments to pay off your loan earlier. The most important part of taking out a loan is making sure you are able to repay the debt - an amortization table can help with that. Amortization schedules help borrowers stay on target when paying off their debts and them to keep their finances organized.

Most HELOCs have two phases, first a draw period and then repayment. The draw period is usually 10 years, during which a borrower can draw as much as he can up to the credit limit. The borrower is only required to make interest payments during the draw payment, although he has the option to pay more towards the principal. After the draw period, the HELOC is closed and enters the repayment period. Borrowers are no longer able to borrow additional money and are required to make regular payments to repay the loan until the loan is paid off.

Amortization calculator and amortization schedule generator

Or to see when you would have enough equity accumulated to move up to a nicer home. By changing any value in the following form fields, calculated values are immediately provided for displayed output values. Determine the home equity line of credit amount you may qualify to receive from Credit Union of America. Use our Home Equity Loan Payment Calculator to figure out how much you can borrow with a home equity line of credit. Lead with HELOC as primary and Home equity line of credit secondary.

However, the formula rendered above does not provide an accurate calculation of a homeowner’s equity, as it is based on an incorrect understanding of what home equity actually is. Home equity is the value of a homeowner’s unencumbered ownership interest in the property that is their home. Another way of expressing home equity is to say that it’s the portion of your home’s market value that is free and clear of your mortgage loan obligation.

Refinancing your HELOC into a home equity loan

Home Equity Loan - You can take out a home equity loan, which has a fixed rate, and use this new loan to pay off the HELOC. The advantage of doing this is that you could dodge those rate adjustments. The disadvantage is that you would be responsible for paying closing costs. It also tells you how much accumulated interest you will have paid at any point in the loan, and how much interest you can expect to end up paying over the life of the mortgage. Learn the difference between draw and repayment periods as well as other things you should consider when calculating your HELOC payments. Use BMO Harris home equity loan or line of credit calculators to see how much your loan payment may be and calculate how much line of credit you can obtain.

Your payment breakdown is very important because it determines how quickly you build home equity. Equity, in turn, affects your ability to refinance, pay off your home early, or borrow money with a second mortgage. HELOCs are different from home equity loans in that they function more like a credit card. Your lender will extend credit, based on several factors including your credit history and the equity in your house. For example, if you’re extended $50,000 and use just $25,000, then you only owe $25,000. You can input data including payoff goal, current interest rate, yearly rate changes and annual fees.

Mortgage amortization FAQ

A business loan could help your business succeed, but you should only consider taking one out if you are sure you can afford to pay it back. Before applying for a business loan, ensure you have the necessary documents. These generally include personal and business credit reports as well as financial and legal documents.

With negative amortization, the loan’s outstanding balance grows larger instead of smaller. Sticking to your loan repayment schedule will avoid negative amortization by paying off each month’s principal and interest charges. Most mortgage loans are ‘fully amortized.’ That means they’re paid off in monthly installments over a set period of time. Enter your original loan amount, interest rate and length of the mortgage in the places indicated. The calculator will immediately show your monthly payments and a breakdown of your total costs and interest costs in the "Total Payments" box further down.

Free Loan Amortization Schedule Templates for Excel

This total payment amount assumes that there are no prepayments of principal. Amortization schedules, provided by the lender when shopping for a loan, project your monthly payments throughout the full term of the mortgage. This chart also gives an estimate of how much equity you’ll have gained in a given month. If you are looking to track the repayment of a home equity line of credit , Vertex42 has a free HELOC calculator with amortization schedule. You simply put in your credit limit and other terms and there are multiple repayment options as well as a schedule that shows you how much you are paying over time.

There are basic Excel loan amortization templates as well as those for home equity loans. However, it is not a very liquid asset, since it can’t be quickly converted into cash. See how much interest you have paid over the life of the mortgage, or during a particular year, though this may vary based on when the lender receives your payments. There are benefits and drawbacks of getting HELOC versus other types of loans and credit cards. Repeat the above steps - repeat until the balance of your loan is 0.

Lastly, a home loan modification brings the home loan current for borrowers experiencing financial hardship. While a loan modification might allow you to become mortgage-free faster, and could reduce your interest burden as well, this option may negatively impact your credit. If you can get a lower interest rate or a shorter loan term, you might want to refinance your mortgage.

When that period ends, you must make principal and interest payments. HELOCsare variable-rate loans, which means your interest rate may adjust periodically. If you’re worried about rising rates, see how much a fixed-rate home equity loan could save you by keeping the rate change field at 0 percent. These are numbered in order so that, for example, the last payment you make in the first year of the loan would be payment #12.

If you are looking for a home equity line of credit calculator, try our HELOC calculator. Smartsheet’s free Balloon loan amortization schedule template assumes that you will have a single large payment at the end of your loan. You enter in all of your mortgage loan terms as you would any other loan as well as the amount of the balloon payment, and this template will provide you with the correct schedule. Microsoft Office has a free basic loan amortization schedule template for Excel that you can download. You enter the loan amount, APR, loan period, number of payments per year, start date of the loan, and an optional amount for extra payments.

A HELOC also tends to come with fewer fees and closing costs than a cash-out refi. This allows you to avoid that principal and interest payment while keeping your line of credit open. If you have improved your credit since you got the first HELOC, you might even qualify for a lower interest rate. As another common installment loan type, personal loans are typically taken out with the expectation that the financing will be repaid in full. Ending Balance.This is the remaining amount due at any period during the loan after a payment has been made. Rate of Interest.This is the value of the payment accrued on the loan, which can be a fixed or variable rate.

Use the calculator below to calculate your monthly home equity payment for the loan from Peoples Bank. You can adjust loan amount, interest rate, and the home equity term to view the impact on the monthly payment amount. The calculator also provides an amortization table to show the amount of principal and interest payments a borrower will make over the life of the loan. Use the calculator below to calculate your monthly home equity payment for the loan from PeoplesBank. Know at a glance your balance and interest payments on any loan with this simple loan calculator in Excel. Just enter the loan amount, interest rate, loan duration, and start date into the Excel loan calculator.

No comments:

Post a Comment