Table of Content

Home equity is calculated as the fair market value of the home, minus the outstanding unpaid balance owed on the property’s mortgage loan, and the total of any other liens on the property. A lien is any debt interest in a property that requires that it be paid off in order to sell the property. If you want to accelerate the payoff process, you can make biweekly mortgage payments or extra sums toward principal reduction each month or whenever you like. This tactic will have minimal impact on your budget, and it will still help you save significantly on interest.

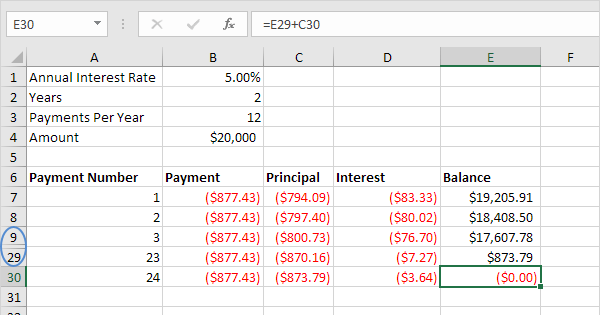

You need only plug in your loan terms such as the total amount, duration, frequency of payments, and interest rate, and the calculator will provide your schedule. As always, Excelchat is available to provide one-on-one help should you require additional assistance with any of these templates or anything else related to Excel. In addition, they might have still owed, for example, $200,000 on their mortgage loan. Therefore, selling their home at its current fair market price would leave the homeowner $20,000 short of being able to pay off their outstanding mortgage loan. Such a situation is described as being “underwater” or “upside-down” in terms of your home’s value in relation to your mortgage loan. To create an amortization schedule by hand, we need to use the monthly payment that we've just calculated above.

Using the Amortization Schedule Calculator

A business loan’s full cost depends on the interest rate, loan amount and loan term. You can estimate the amount your business will need to pay each month and overall by entering these three numbers into the Bankrate business loan calculator. Borrowers who fall behind on their home or car loan payments could experience negative amortization.

Starting from the second payment, you need to use the remaining balance instead of the initial loan amount in your calculation for steps 1 & 3. Business credit cards allow you to borrow what you need when you need it up to a credit limit. Credit cards also may come with perks like rewards programs, sign-up bonuses and an introductory period with 0 percent APR.

Home Equity Line Of Credit (HELOC) – Rocket Mortgage

When you make payments early in a loan, more of the payment goes towards interest, but this changes over time, where a larger portion will pay down the principal as your loan term progresses. Assume that the homeowner, Aurora, bought her current home for a price of $220,000 eight years ago. When she bought the home, she made a down payment of $35,000 and financed with a 15-year mortgage loan the balance of the purchase price – $185,000. The remaining principal balance owed on her mortgage loan is $110,000. Initially, most of your payment goes toward the interest rather than the principal.

As a piece of the overall scheduled payment, the principal payment on your amortization table indicates how much of your mortgage bill is going towards bringing down the loan’s principal. Amortization schedules help borrowers understand the amount they’ll be paying each month after they take out a loan. It also charts the breakdown of each payment, indicating how much of the installment goes towards interest vs. the loan’s principal. Most borrowers take out a loan with the goal of full amortization in mind. A fully amortized loan would result in the principal balance dwindling to zero at the conclusion of the loan’s term. While some general loan amortization templates will work for a mortgage, there are nuances with these loans that are best handled by a specialized template.

Search Banks / Credit Unions / Articles

Use this calculator to input the details of your loan and see how those payments break down over your loan term. You can speed up any loan’s amortization schedule by making extra payments, or making larger-than-required payments, each month. A mortgage calculator can show the amortization schedule for a fixed-rate loan. Just enter your interest rate, loan amount, loan term, down payment, and other variables. Then click on “view full report” to see a graph showing the loan’s amortization. For the first few years of your loan, your amortization schedule will show the majority of your monthly payment going towards interest.

Before you begin working with amortization schedules, it will be helpful to learn a few common terms and definitions. If you’ve taken out a loan or plan to do so in the future, you are committing yourself to making certain payments to the lender. How you track these payments and fit them into your overall budget can be a challenge, unless you have a process and the right calculation to follow. Determine how much extra you would need to pay every month to repay the full mortgage in, say, 22 years instead of 30 years.

Accountants think of amortization a little differently than mortgage borrowers. They use amortization to spread the cost of an intangible asset over its useful life. They also use depreciation and depletion to show the changing value of tangible assets on their balance sheets. Fortunately, mortgage borrowers have a much simpler way to use amortization schedules.

Note that you can choose to see the effects of a single extra payment or paying extra on a monthly or annual basis. Mortgageloan.com is a product of ICB Solutions, a division of Neighbors Bank. ICB Solutions partners with a private company, Mortgage Research Center, LLC, (nmls # 1907), that provides mortgage information and connects homebuyers with lenders. Neither Mortgageloan.com, Mortgage Research Center nor ICB Solutions are endorsed by, sponsored by or affiliated with any government agency. ICB Solutions and Mortgage Research Center receive compensation for providing marketing services to a select group of companies involved in helping consumers find, buy or refinance homes. If you submit your information on this site, one or more of these companies will contact you with additional information regarding your request.

Some borrowers prefer investing their money somewhere else — in stocks or in a second home, for example — instead of paying off their mortgage sooner. You should meet with a financial planner if you need help weighing the pros and cons. Mortgage lenders add these costs onto your principal and interest payments because lenders have a financial interest in keeping these bills paid.

At the end of a fully amortizing mortgage loan, you’ll own your home outright. But because of the way mortgage loans amortize, that equity builds up slowly as you pay off the loan. Homeowners might not pay attention to their amortization schedule, because their total payment does not change. Most lenders don’t offer these — and most home buyers don’t want them — because these loans are riskier and don’t help the borrower build equity as quickly.

But most lenders also offer 15-year home loans, and some even offer 10 or 20 years. Some homeowners decide to pay off their mortgage early as a way to save on interest payments. You need more than 20% equity to draw on your home’s value via a cash-out refinance or home equity loan. Your amortization schedule will help you understand when you can reach the magic number to become eligible for home equity financing. Although the full loan term is 30 years, it will take the homeowner 19 years — nearly two-thirds of the term — to pay off half their loan principal.

Regular payments include other homeownership costs, too, like homeowners insurance, property taxes, and if necessary, private mortgage insurance and/or homeowners association dues. Almost all mortgages are fully amortized — meaning the loan balance reaches $0 at the end of the loan term. It works much like a credit card — you are able to use it as needed. One is that the balance on your HELOC is likely to be higher than your credit card balance. Another is that HELOCs currently have single-digit interest rates, compared to the 16 percent or more you’ll pay if you carry a balance on a credit card. Many HELOCs allow borrowers to make interest only payments during the draw period, which can vary.

No comments:

Post a Comment